Loans Made Easy.

Opportunities Made Possible.

Whether you’re a public servant or in the private sector, our digital loan process puts money in your hands, fast.

22,463+

Processed Loans

15321+

Customers

365

Working Days

100+

Workers

Loans

Our personal loan enjoys good attention as our customers enjoy diverse products with personalized interest rates and flexible terms. This includes swift cash loan, emergency loans, auto-loans, debt consolidation, etc

Why DMB

DMB operates ethical lending, clear disclosures, and responsible collections. All loans are subject to approval and employer enrolment where required.

Payroll‑powered lending:

Repay automatically through your employer’s payroll or via a secure debit mandate.

Fixed rates & clear terms:

No collateral for standard products; fees disclosed upfront.

Fast decisions & disbursement:

Same‑day disbursement after approval and payroll/debit setup.

Technology + experienced people:

Smart decisioning, dedicated support.

About Us

Dominion Merchants & Partners International Ltd is a forward-thinking financial services company committed to making access to credit simple, fast, and reliable. We specialize in providing loan solutions to civil and public servants, individuals, and SMEs, ensuring that financial support is always within reach when it matters most.

Our vision is clear to transform into a Pan-African financial institution that redefines lending through speed, innovation, technology, and trust. By focusing on customer needs and streamlining processes, we eliminate the barriers to finance and deliver services that empower people, strengthen businesses, and boost economic growth.

DMB Public Sector Loans

We have partnered with public service offices as we were issued our unique repayment code that allows us make direct deductions from the salaries of the respective employee civil servants on a monthly basis. This grants us the uncommon benefit of seamless loan relationship with the large number of over 800,000 uniformed customers to include:

Nigeria Immigration Service

Federal Fire Service

Nigeria Correctional Service

FCTA

Nigeria Customs Service

Nigeria Police Force

Federal Universities

Nigeria Security and Civil Defence Corps

Federal Polytechnics

MDAs (Ministries, Departments & Agencies)

Federal Colleges of Education

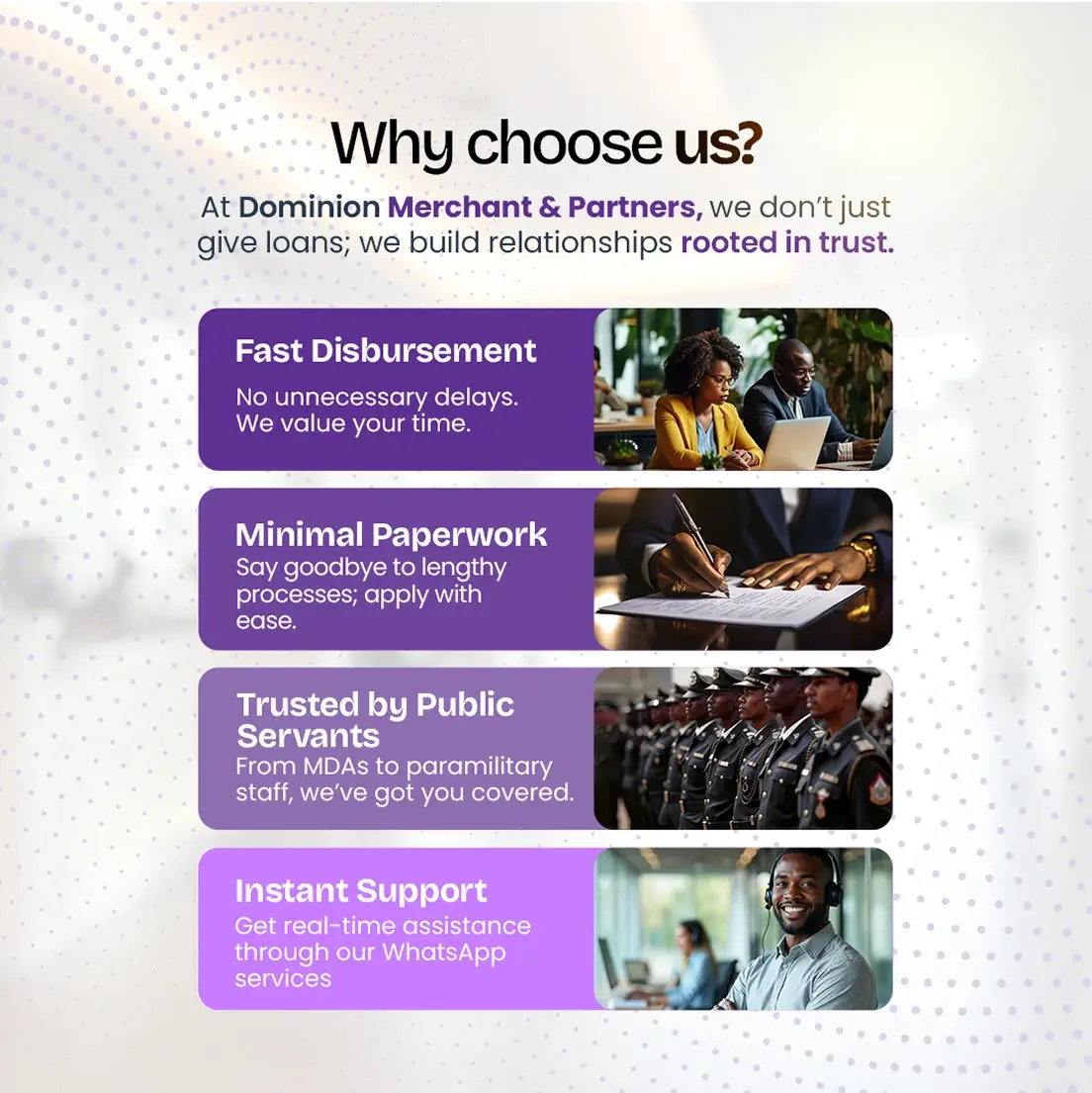

Why Choose Us

At Dominion Merchants & Partners, we don’t just give loans; we are your financial partners. Our strength lies in providing quick, transparent, and flexible loan solutions tailored to individuals, employees, and businesses.

With innovative technology and streamlined processes, we ensure fast approvals, minimal documentation, and reliable repayment options. Dominion Merchants & Partners is your trusted ally for smarter, faster, and more secure financial services.

Mission Statement

To consistently exceed customers' and stakeholders' expectations through a skilled and motivated workforce, leveraging new technologies.

Our Values

Dominion Merchants and Partners Limited (DMB) is a financial services provider committed to driving social and economic growth through inclusive, digital lifestyle and financial solutions. DMB serves a diverse and expanding customer base across Nigeria. We are optimistic about the renewed national focus on economic development and confident that the current administration will positively influence our business and the broader financial ecosystem.

Excellence

We pursue excellence in every service, transaction, and relationship. From the first interaction to the final repayment, we ensure top-tier experiences for our clients and partners.

Trust

Trust is our currency. We operate with integrity, transparency, and accountability, building lasting relationships grounded in mutual respect and reliability.

Speed

We move fast because your needs can’t wait. Our systems are designed for quick approvals, fast disbursements, and swift support; ensuring that time is always on your side.

Accuracy

Every detail matters. We uphold the highest standards of precision in our data, calculations, and communications to ensure informed decisions and flawless execution.

Flexibility

Every client is unique. We adapt our services to meet your specific needs, offering personalized solutions and flexible terms that align with your lifestyle or business goals.

Technology

We harness the power of technology to simplify access, improve efficiency, and ensure smarter financial services. Our tech-first approach keeps us agile, secure, and always connected to your needs.

Innovation

We challenge the status quo. Through bold thinking and creative solutions, we design financial products and services that evolve with the times and empower our clients.

Consistency

We deliver results, not just once, but every time. Our clients can rely on a standard of excellence that never drops, no matter how much we scale or evolve.

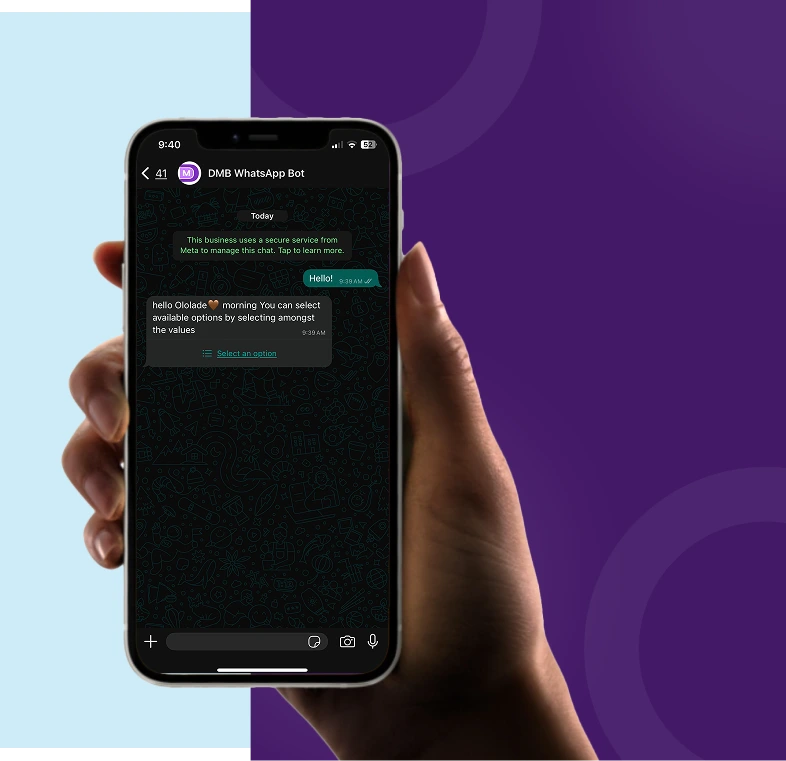

Introducing the Dominion WhatsApp Bot; Banking at Your Fingertips

In today’s fast-paced world, convenience is king. That’s why we’re introducing the Dominion WhatsApp Bot; your 24/7 personal assistant for quick loan applications and instant customer support.

With just a few taps, you can start and complete your loan application or speak directly with our customer care team, all from the comfort of your phone.

How it Works

Apply for loans, check eligibility, and connect directly with our support team; all from your phone.

- 1

Start the Chat: Click the WhatsApp link on our website or message us at +234 812 610 0077.

- 2

Choose a Service: Select from Support, Public Servant, or Private Sector options.

- 3

Follow the Prompts: Provide the requested details, upload required documents, and confirm your application.

- 4

Get Instant Feedback: Receive your loan eligibility, repayment terms, and next steps, all on WhatsApp.

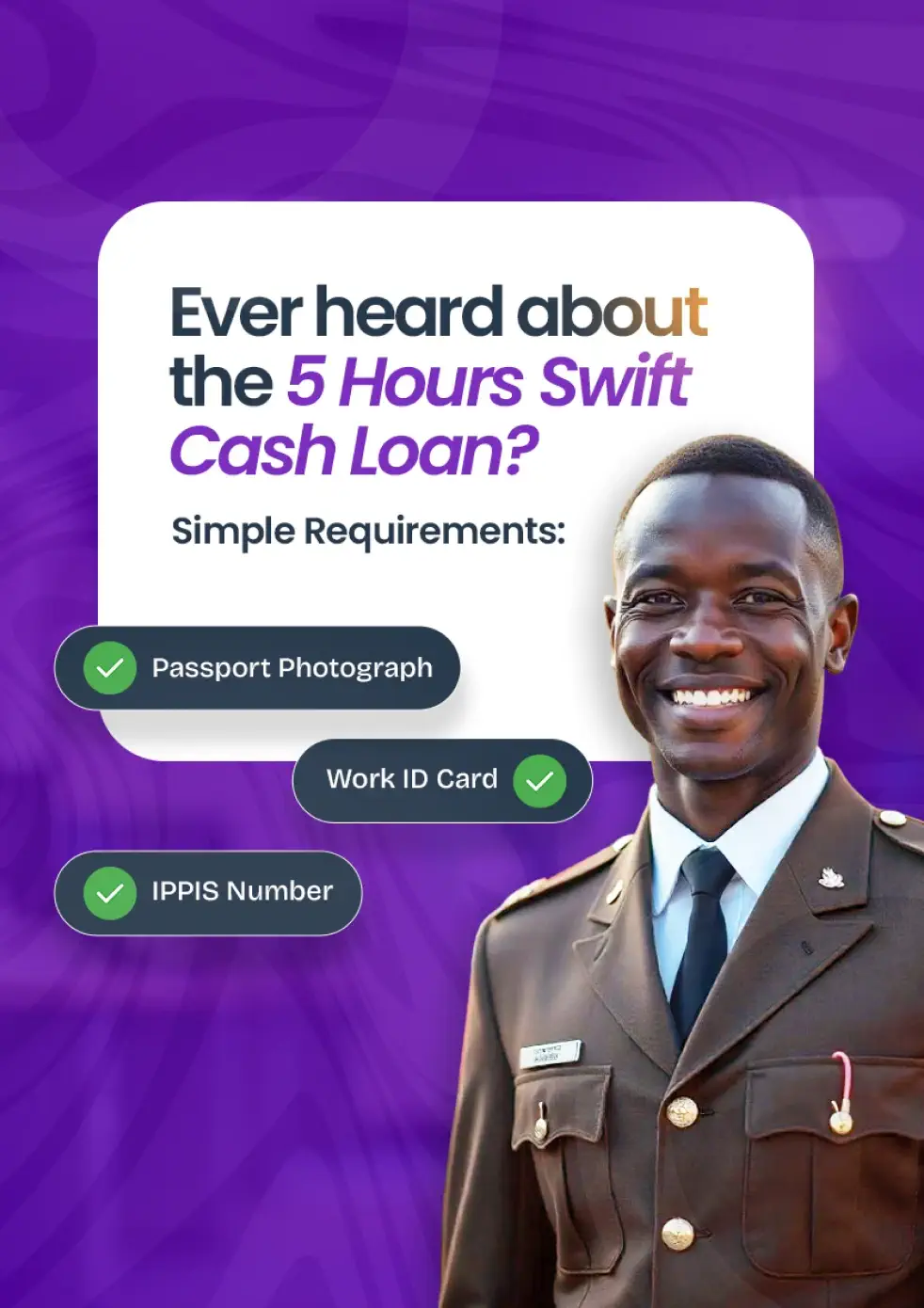

Swift Cash Loan

Life doesn’t wait, and neither should your finances. With Dominion Merchant & Partners’ Swift Cash Loan, you can access funds in as little as 5 hours; fast, secure, and hassle-free.

Why Choose Swift Cash Loan?

- Quick Approval: No long waits or endless paperwork

- Flexible Repayment: Tailored to your financial comfort

- No Collateral Needed: Verified employment and salary are enough

Our Products

DMB Deduction-At-Source Loan Program: Payroll deduction loans for pre-profiled public and private-sector employers, enabling seamless monthly repayment from salary.

Public Sector Loan (Swift Cash)

We hold a unique repayment code with partnered public offices, allowing direct salary deductions and a seamless loan relationship for eligible employees. Coverage includes over 480,500 public‑sector employees across our partners.

Benefits for employees

- Minimal documentation

- Tenor: 12-24 months (simple, flexible)

- Top‑ups: Eligible after your first three successful instalments

- Dedicated online portal: Easy, mobile‑friendly application

- Fast disbursement: Same day after approval & payroll setup

Loans for Employee Emergency (LEE) Program

This short‑term payroll loan is for employees of pre‑profiled and registered companies. LEE delivers quick access to funds for urgent needs; medical, rent gaps, school fees without collateral.

Eligibility & documents

- Must be a salaried employee of a DMB‑registered employer

- Minimum time‑in‑employment and net pay thresholds may apply

- Required docs: staff ID/employment letter, last 3 payslips, valid ID (NIN/Passport/Driver’s Licence), BVN

DMB Personal Loans

Flexible, unsecured personal loans with personalized fixed rates, ideal for emergencies, auto expenses, or debt consolidation.

What you’ll need

- Valid ID & BVN

- Proof of income (recent payslips/bank statements)

- Employer details (if applicable) and payroll/debit mandate authorization

Private Sector Loans: We understand the unique financial needs of private sector employees. Whether it’s for personal projects, emergencies, or investment opportunities, or small business etc, our Private Sector Loans are designed to give you quick and reliable access to funds when you need them most.

SME Loans

Specially designed for small and medium-sized enterprises to grow and thrive. Whether it's for working capital, inventory purchase, equipment acquisition, or expansion. We understand that SMEs are the backbone of the economy, and our loan solutions are built to support their sustainability and growth. All with flexible terms and amounts up to #10 million.

Auto Loans (Car 2 Cash)

Turn your car into cash without losing ownership. Bring your car as collateral and access quick funds with flexible repayment plans and transparent terms.

Here’s how it works:

- Bring in your car as collateral.

- Access instant cash to meet personal or business needs.

- Flexible repayment plans tailored to your capacity.

- Retain ownership of your car while enjoying financial relief.

- Transparent terms; no hidden charges. At DMB, your car secures your loan, and your needs get met.

Assets Finance

Whether you need equipment for your business, household appliances, or other valuable assets, Dominion Merchant Asset Finance gives you the leverage you need.

- Access the tools you need today and spread payments over time.

- Transparent terms: no hidden costs.

- Customizable repayment plans to suit your cash flow.

- Eligibility for public/civil servants, SMEs, and individuals.

- With Asset Finance, you get more than a loan; you get the support to grow, achieve, and thrive.

FAQs

Got Questions About Our Public Sector Loans?

Find quick answers to common questions on eligibility, repayment, and more in the FAQ below.

What is Dominion Merchants & Partners International Ltd (DMB)?

What types of loan products do you offer?

Who is eligible for loans from DMB?

How quickly can I receive a loan?

How much can I borrow?

What are the documentation and repayment terms?

Are there options for loan top-up or refinancing?

What risk mitigation measures are in place?

What sets Dominion Merchants apart from competitors?

Success Stories

Haruna B.

Ibadan

"I had just started a new job when I needed a flexible personal loan. Dominion worked with my employer and structured a plan that fit my salary. Their flexibility made all the difference."

Chinwe E

Enugu

"As an entrepreneur, I’ve accessed funding twice from Dominion to keep my operations running. Their consistency and speed helped me stay afloat and even expand. I’m grateful for their support."

Ready to Get Started?